Beyond the obvious

What are non-consensus bets in the AI era?

For decades, venture wisdom has coalesced around a single axiom: You make all your money on successful and non-consensus. Marc Andreessen has said that when you do venture “right,” you invest in things that feel crazy at the time —because by definition, if something is already consensus, the upside has already been priced in.

That remains true. But AI has changed all that.

Last year, 41% of all U.S. venture capital went to just ten companies—nearly half the market concentrated into two hands’ worth of bets. Many of these companies are building the next generation of foundational AI infrastructure, and hopefully they will be massive winners. But here’s the quiet risk: by focusing so intently on a small set of “inevitable” category leaders, we risk missing the other forty companies that will quietly join the Fortune 50 in the decade ahead.

The Narrow Lens Problem

Investor screens have collapsed into a kind of checklist minimalism:

Massive TAM now and on paper, not later and emergent

AI-native, in the “right” categories

A well-worn path to a category-defining moat

That lens is useful—but incomplete. It tends to overlook:

Deep tech, from robotics to medical devices, where early customers fund deep technical moats

Legacy industries, where go-to-market is the true defensibility

AI-native models whose business architecture doesn’t mirror last decade’s SaaS

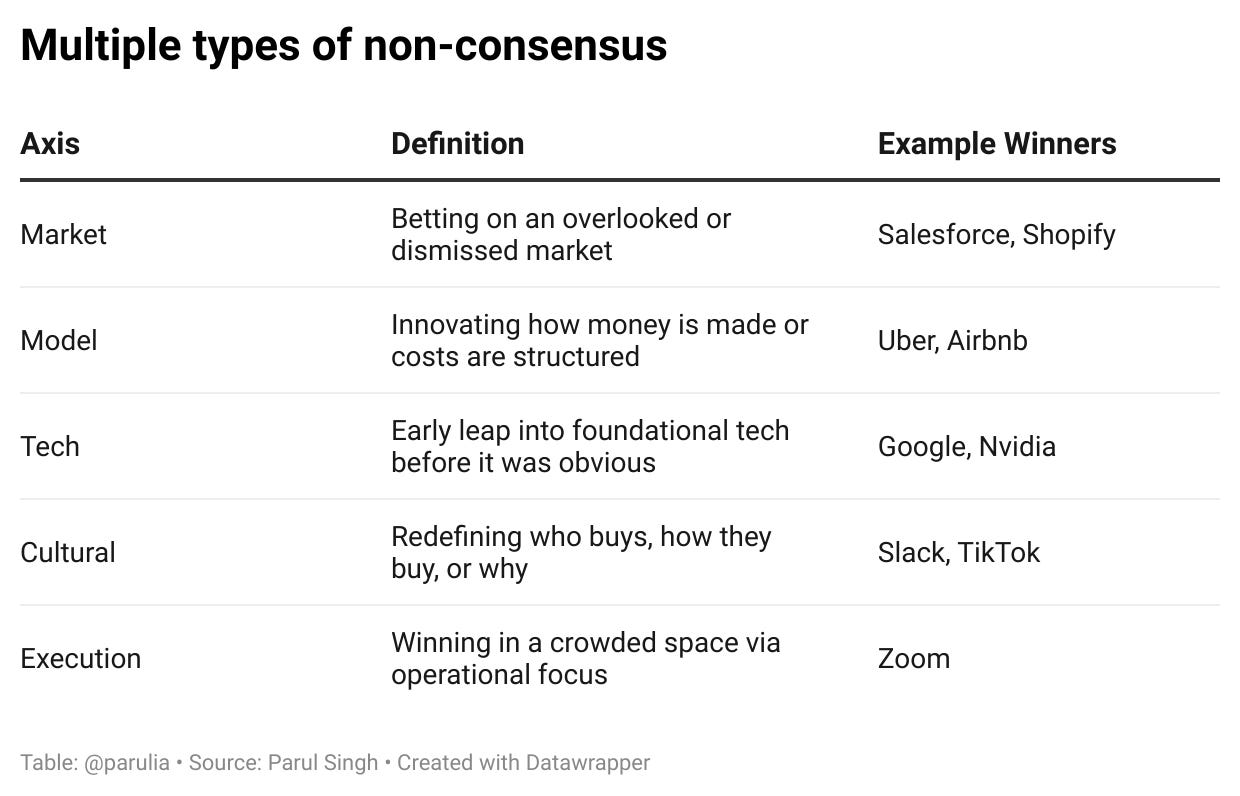

Multiple Axes of Non-consensus

Non-consensus isn’t a single lane — it’s a five-lane highway, and most investors are driving in only one.

Uber was tech + model. Tesla was tech + cultural. Stripe was model + tech.

Right now, capital is heavily overweighted toward tech non-consensus — leaving room for under-the-radar entrants that win through market, model, and cultural non-consensus, or better still, unique combinations.

Blind Spot Mapping

Blind spots are rarely empty — they’re simply places our prevailing story refuses to look.

Ask yourself:

Why is no one here? Is it unsexy, regulated, fragmented, or low-margin?

What’s changing now? New tech, regulatory shifts, cultural tailwinds, enabling infrastructure?

Is the “too early” about to become “too obvious”?

Blind spots follow an inverted hype curve: first ignored, then inevitable.

GTM as a Moat

Products can be copied. Channels can be owned.

In the AI era, where features commoditize quickly, the path to market may be the most enduring advantage of all.

True GTM moats include:

Locked-in channels (Salesforce AppExchange, Shopify ecosystem)

Community-led growth (Notion, Figma)

Regulatory credibility (healthtech with FDA clearance)

Partnership flywheels (AWS partners, Palantir in defense)

For Founders: Your Best Compass

Being strategic doesn’t mean chasing the categories VCs are excited about this quarter. It means returning to your strengths — the vantage only you can occupy.

Ask yourself:

Where do my skills, experience, and network give me a GTM edge others can’t match?

Which “unsexy” categories do I understand better than most, where tailwinds could unlock massive growth?

How can I combine market, model, tech, cultural, and execution non-consensus to create something truly new?

You don’t need any investor’s permission to pursue the problem that keeps you up at night. You do need the courage to ignore the noise and build.